Table of Contents

- Understanding the Basics of Energy Efficiency Federal Tax Credits

- Eligibility Criteria for Claiming Energy Efficiency Tax Credits

- Exploring Eligible Improvements and Their Tax Benefits

- Navigating the Application Process for Energy Tax Credits

- Maximizing Your Savings through Smart Energy Upgrades

- Q&A

- In Summary

Understanding the Basics of Energy Efficiency Federal Tax Credits

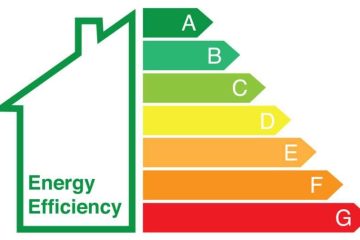

Energy efficiency tax credits are designed to incentivize homeowners and businesses to invest in renewable energy and energy-saving upgrades. By utilizing these credits, you can significantly reduce the upfront costs associated with making your property more energy-efficient. Understanding how these federal tax credits work can lead to substantial savings over time while contributing to a more sustainable environment.

The types of improvements that qualify for these credits typically include:

- Solar Energy Systems: This includes solar panels and solar water heating systems.

- Geothermal Heat Pumps: A sustainable option that harnesses the earth’s natural heat.

- Energy-Efficient Windows: Replacement windows that have a higher insulation rating can qualify.

- Insulation Materials: Special materials that improve your home’s thermal efficiency.

For those looking to take advantage of these credits, it’s essential to keep detailed records of qualifying purchases and installations. Below is a simplified table showcasing the potential savings based on different energy-efficient upgrades:

| Upgrade Type | Estimated Tax Credit |

|---|---|

| Solar Panels | 26% of Installation Costs |

| Geothermal Heat Pump | 26% of Total Costs |

| Energy-Efficient Windows | Up to $500 |

By understanding the ins and outs of these credits, you can make informed decisions about energy-efficient home improvements and explore the financial benefits that come with them. Taking full advantage of available credits not only rewards your investment but also aids in the overall reduction of energy consumption, making it a win-win for your wallet and the planet.

Eligibility Criteria for Claiming Energy Efficiency Tax Credits

To qualify for the energy efficiency tax credits, taxpayers must meet specific conditions set forth by the IRS. These criteria primarily target residential property owners who have invested in energy-efficient home improvements or installations. Eligible improvements include, but are not limited to:

- Insulation upgrades

- Energy-efficient windows and doors

- Heating and cooling systems

- Renewable energy installations like solar panels

Furthermore, it’s important to note that not all energy-efficient products automatically qualify for tax credits. These products must meet the energy performance standards as defined by the IRS. Homeowners are encouraged to verify that the products they intend to use carry the Energy Star mark, which typically indicates compliance with these standards. For installations, get advice from a certified professional to ensure the work meets specifications.

Taxpayers must also earn income within the defined ranges, as the credits phase out for higher income levels. To aid in understanding eligibility, here’s a quick reference table showing the maximum eligible income levels for single filers and joint filers:

| Filing Status | Maximum Income for Full Credit |

|---|---|

| Single | $80,000 |

| Married Filing Jointly | $160,000 |

It’s essential for individuals considering these credits to carefully document their expenses and maintain receipts, as proof of eligibility may be required during tax filing. Consulting with a tax professional can also provide personalized guidance, ensuring you maximize your benefits while remaining compliant with all IRS regulations.

Exploring Eligible Improvements and Their Tax Benefits

When it comes to making your home more energy-efficient, various enhancements can qualify for significant tax credits under federal programs. Homeowners often overlook the potential financial benefits that come with undertaking these improvements. By making strategic upgrades, not only can you lower your energy bills, but you can also boost your tax savings. Some eligible improvements include:

- Insulation: Adding or improving insulation in your home can help maintain your desired temperature, reducing reliance on heating and cooling systems.

- Energy-efficient windows: Replacing old windows with ENERGY STAR® certified models can minimize heat loss, providing both comfort and savings.

- Heating and cooling systems: Upgrading to a high-efficiency furnace, heat pump, or air conditioning unit can significantly reduce energy consumption.

- Renewable energy systems: Installing solar panels or wind turbines can earn you substantial credits to offset installation costs.

Furthermore, understanding the specific percentages of tax credits for each improvement can help you maximize your benefits. The federal tax credits typically cover a percentage of the costs associated with eligible improvements, which can amount to a substantial deduction on your tax return. For instance, here’s a simple breakdown of some common improvements and their respective tax credit percentages:

| Improvement Type | Tax Credit Percentage |

|---|---|

| Insulation | 10% of cost |

| Energy-efficient windows | Up to $200 |

| High-efficiency heating/cooling systems | Up to $500 |

| Solar energy systems | 26% of cost |

it’s important to keep proper documentation of all upgrades, including receipts and any certifications for the products installed. This documentation will be essential when it comes time to file your taxes and claim these credits. With a bit of planning and awareness, homeowners can leverage these benefits to create a more sustainable living environment while enjoying substantial financial rewards. Investing in energy-efficient improvements not only enhances your home but also helps contribute to a greener economy.

Navigating the Application Process for Energy Tax Credits

Understanding the steps involved in securing energy tax credits can significantly ease your financial burden while making environmentally friendly upgrades. First, research the specific credits available that meet your needs. The IRS provides a wealth of information about various energy-efficient expenditures that qualify. Focus on the credits related to solar energy systems, high-efficiency HVAC equipment, and energy-efficient windows or doors. By narrowing down your options, you can streamline the application process and identify which credits suit your project type.

Once you have selected the applicable credits, collect and organize necessary documentation. Gather receipts, invoices, and manufacturer’s certifications related to your energy-efficient purchases. It’s essential to ensure that your purchases comply with the eligibility criteria laid out by the IRS. To stay organized, create a checklist to track your documents, so nothing is overlooked. Consider using digital tools or spreadsheets to maintain a clear overview of your application requirements.

when you’re ready to apply, fill out the appropriate forms correctly. Most energy tax credits require you to complete IRS Form 5695, which will facilitate your claim for residential energy credits. Ensure that all information is accurate, as discrepancies can lead to delays or even denial of your credit. After filing your tax return, keep a copy of your application and all supporting documents for your records. Proper preparation not only simplifies the process but also maximizes your chances of receiving the credits you deserve.

Maximizing Your Savings through Smart Energy Upgrades

Investing in energy-efficient upgrades not only helps the environment but can also lead to significant long-term savings on your utility bills. By taking advantage of federal tax credits, homeowners can reduce the upfront costs associated with these enhancements. Consider focusing on improvements that offer both immediate benefits and sustainable savings over time. Here are some key upgrades to consider:

- High-Efficiency HVAC Systems: Replacing outdated heating and cooling systems with Energy Star-rated models can cut your energy consumption dramatically.

- Insulation and Air Sealing: Proper insulation and sealing drafts can help maintain your home’s temperature, reducing the workload on heating and cooling systems.

- Energy-Efficient Windows: Installing double or triple-glazed windows minimizes heat transfer, enhancing comfort and lowering energy costs.

Many homeowners might not realize the extent of savings available through these upgrades. Federal tax credits can cover a percentage of the costs for qualifying devices and installations, providing a valuable financial incentive. Since these credits often change, staying informed about the current offerings is crucial. Below is a simple overview of potential savings and eligibility:

| Upgrade Type | Potential Tax Credit | Lifetime Savings Estimate |

|---|---|---|

| HVAC System | up to $300 | $1,000+ |

| Insulation | up to $500 | $500+ |

| Windows | up to $200 per window | $1,200+ |

Q&A

Q&A: Understanding the Energy Efficiency Federal Tax Credit

Q1: What is the Energy Efficiency Federal Tax Credit? A1: The Energy Efficiency Federal Tax Credit is a financial incentive provided by the government to encourage homeowners and businesses to invest in energy-efficient upgrade measures. By taking advantage of this tax credit, individuals can potentially reduce their tax liability when they invest in qualifying energy-efficient products and systems, such as insulation, windows, and heating and cooling systems.Q2: Who is eligible for this tax credit? A2: Eligibility typically extends to homeowners who make energy-efficient upgrades to their primary residence, as well as certain businesses. To qualify, the improvements must meet specific energy efficiency requirements set by the Internal Revenue Service (IRS) and must be installed in a home that was in use at the time of the upgrade.

Q3: What improvements qualify for the Energy Efficiency Federal Tax Credit? A3: Qualifying improvements include energy-efficient insulation, exterior windows and doors, roofing, HVAC systems, and water heaters. Some types of renewable energy systems, such as solar panels and geothermal heat pumps, may also qualify for additional credits. It’s essential to check the official IRS guidelines to confirm which itemized upgrades will allow you to benefit from the credit.

Q4: How much can I save with this tax credit? A4: The savings can vary widely based on the improvements you make. Depending on the type of upgrade, you may be eligible for a tax credit up to 30% of the cost of renewable energy installations or specific dollar amounts for other qualifying energy-efficient home improvements. It’s advisable to keep all related receipts and documentation for accurate reporting.

Q5: How do I claim the Energy Efficiency Federal Tax Credit? A5: To claim the tax credit, you’ll need to fill out IRS Form 5695 as part of your federal income tax return. This form helps calculate the credit amount based on your qualifying expenses. Be sure to retain all receipts and manufacturer certification statements for your records in case of an audit.

Q6: Is there a deadline for claiming this tax credit? A6: Yes, the tax credit is subject to specific deadlines tied to the tax year in which you made the qualifying upgrades. It’s essential to stay updated on congressional decisions, as these credits can be renewed or adjusted, impacting future eligibility and amounts.

Q7: What if I have further questions about my situation? A7: If you have specific questions or unique circumstances, it’s wise to consult with a tax professional or financial advisor. They can provide personalized guidance based on your situation and help ensure you maximize your benefits from the tax credit. Additionally, resources like the IRS website offer a wealth of information on the most current details and requirements.

By answering these frequently asked questions, you can better navigate the complexities of the Energy Efficiency Federal Tax Credit, making informed decisions that enhance both your home and your financial health.

0 Comments