Table of Contents

- Understanding IRS Energy Efficiency Guidelines

- Key Tax Benefits of Energy Efficiency Improvements

- Best Practices for Documenting Energy Efficiency Projects

- Exploring Renewable Energy Incentives under IRS Regulations

- Navigating the Application Process for Energy Efficiency Tax Credits

- Q&A

- Closing Remarks

Understanding IRS Energy Efficiency Guidelines

Energy efficiency guidelines set forth by the IRS are crucial for taxpayers seeking to maximize their benefits while aligning with federal sustainability goals. These guidelines outline which energy-efficient products and systems qualify for various tax incentives. Key areas of focus include residential energy efficiency upgrades such as HVAC systems, insulation, and energy-efficient windows. Taxpayers must ensure that the products meet specific standards defined by the IRS to take full advantage of available credits and deductions.

To better understand eligibility and application, it’s essential to consider the following aspects of the IRS energy efficiency guidelines:

- Qualified Products: Ensure that the items meet the Energy Star certification or other qualifying standards.

- Installation Requirements: Proper installation is often a requirement for claiming credits, so hiring certified professionals can be beneficial.

- Documentation: Keeping accurate records, such as receipts and manufacturer certifications, is necessary for proper filing and potential audits.

Furthermore, different tax credits, such as the Residential Energy Efficient Property Credit, have varying eligibility criteria and benefit amounts. For instance, here’s a simplified comparison of common energy efficiency tax incentives:

| Type of Upgrade | Credit Amount | Requirements |

|---|---|---|

| Solar Panels | 26% of cost | Must be installed by a licensed contractor |

| Energy-Efficient Windows | $200 credit | Must meet specific performance ratings |

| High-Efficiency HVAC | $300 credit | Must be installed by a professional |

Key Tax Benefits of Energy Efficiency Improvements

Implementing energy efficiency improvements not only reduces utility bills but can also lead to significant tax advantages. Homeowners and businesses that invest in energy-saving upgrades might qualify for various federal and state tax credits and deductions. These benefits serve as a strong incentive for individuals and organizations to pursue greener options, making energy efficiency discussions increasingly relevant.

Among the prominent tax benefits available are credits for renewable energy installations, such as solar panels and wind turbines. These installations can garner a federal tax credit of up to 30% of the installation cost. Additionally, efficiency upgrades to heating and cooling systems, insulation, and energy-efficient windows can also qualify for tax credits under the energy efficiency program. These financial incentives not only offset initial costs but also promote long-term savings through reduced energy consumption.

Furthermore, businesses can leverage deductions for energy-efficient improvements made to their properties. For instance, the Section 179D deduction allows for deductions of up to $1.88 per square foot for specific energy management systems. This approach enables companies to enhance their environmental performance while optimizing their tax strategies. To ensure maximum benefits, it’s essential for taxpayers to stay informed about the latest IRS guidelines and verify eligibility for each tax benefit related to energy efficiency improvements.

Best Practices for Documenting Energy Efficiency Projects

Documenting energy efficiency projects effectively is crucial not only for compliance with regulations but also for maximizing financial incentives and improving future projects. To ensure your documentation is comprehensive and valuable, start by establishing clear goals and objectives for each project. This clarity will guide your documentation process and align stakeholders on the project’s vision.

- Utilize standardized templates to maintain consistency across projects.

- Include detailed project descriptions, outlining the scope, timelines, and stakeholder responsibilities.

- Incorporate data analysis to measure energy savings accurately.

Another best practice is to keep meticulous records of all project phases. Create an organized digital or physical filing system that captures the evolution of the project from inception to completion. Documenting every aspect, such as meetings, communications, and milestones, will provide a comprehensive view that is invaluable for reporting and future reference. Ensure you include:

- Before and after energy usage metrics to showcase improvements.

- Cost analyses that outline the financial impact of your efficiency measures.

- Incentive applications and their outcomes to enhance your understanding of available benefits.

Regularly review and update your documentation practices. As energy efficiency guidelines evolve, so should your method of documenting projects. Engage with stakeholders and collect feedback to identify areas for improvement and ensure that your documentation remains relevant. Additionally, consider creating a simple tracking table to summarize project outcomes:

| Project Name | Energy Savings (kWh) | Cost Savings ($) | Date Completed |

|---|---|---|---|

| LED Retrofit | 10,000 | 1,200 | 01/15/2023 |

| Building Insulation | 15,000 | 1,800 | 03/22/2023 |

Exploring Renewable Energy Incentives under IRS Regulations

The IRS provides a range of incentives designed to boost investment in renewable energy sources. These incentives encourage both individuals and businesses to adopt cleaner energy solutions, ultimately supporting the transition towards a more sustainable economy. Key programs include tax credits and deductions that aim to lower the upfront costs associated with the installation of renewable energy systems.

Some notable renewable energy incentives include:

- Investment Tax Credit (ITC): Offers a significant tax credit based on the cost of solar energy systems installed.

- Production Tax Credit (PTC): Provides a per-kilowatt-hour tax credit for electricity generated by qualifying renewable energy sources.

- Residential Energy Efficient Property Credit: Allows homeowners to claim a credit for renewable energy systems they install, such as solar panels or wind turbines.

Furthermore, these IRS incentives can be combined with state and local programs, enhancing potential benefits. For instance, when leveraging federal credits such as the ITC, individuals and businesses might also qualify for additional state tax deductions or rebates, effectively maximizing their return on investment. Understanding how these incentives interact with one another can significantly streamline both financial planning and the implementation of eco-friendly energy solutions.

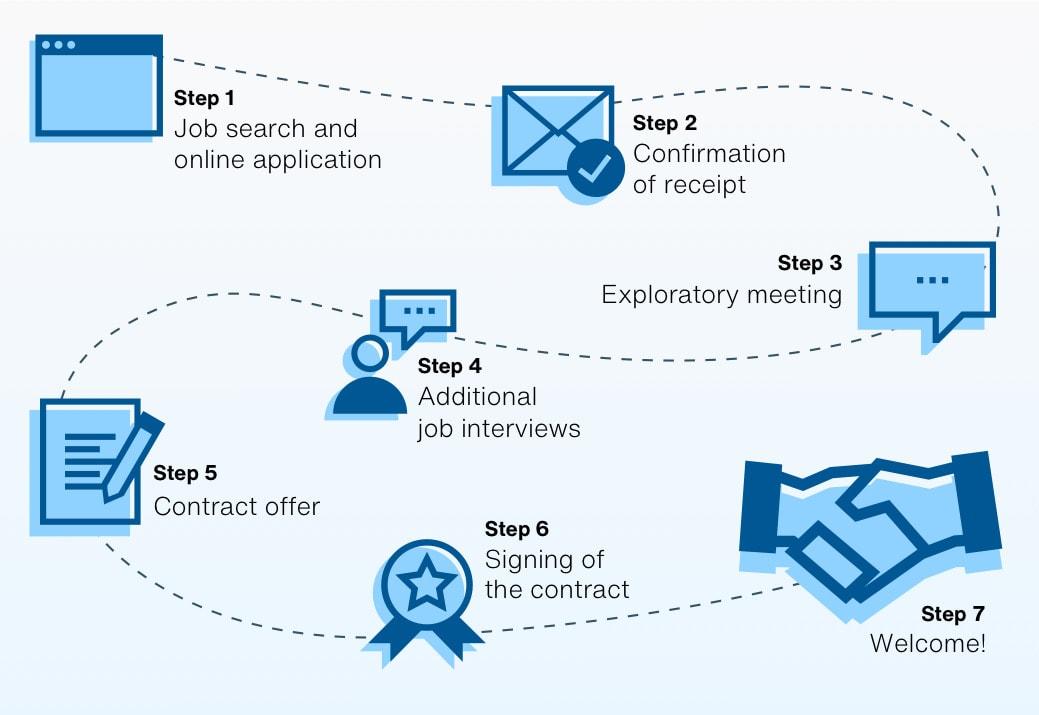

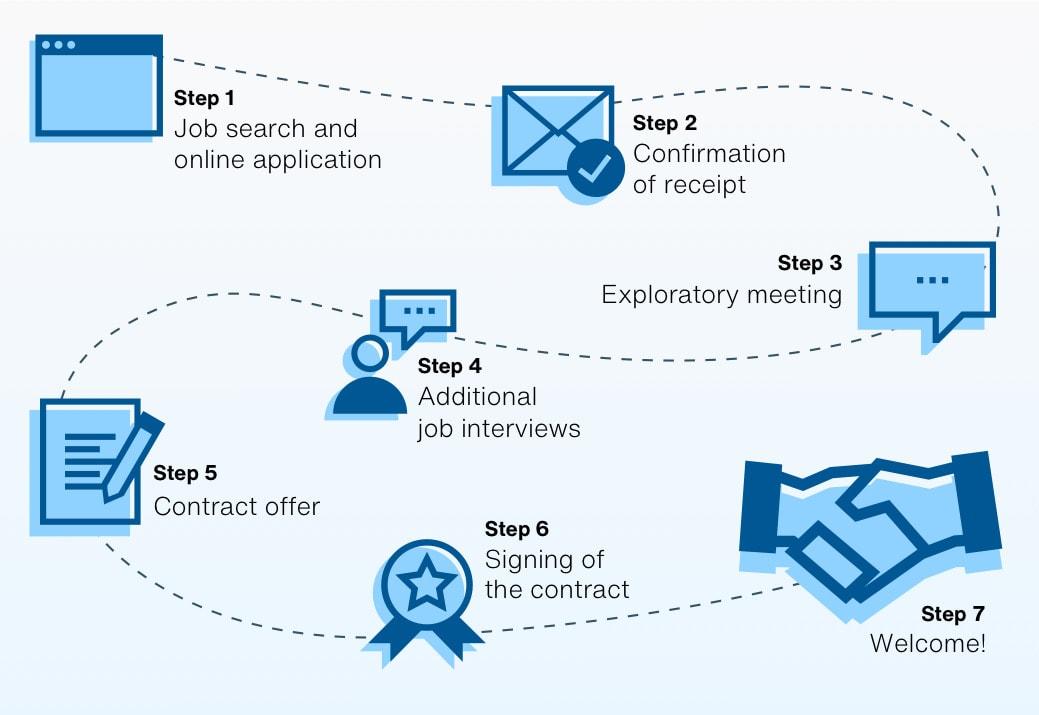

Navigating the Application Process for Energy Efficiency Tax Credits

Applying for energy efficiency tax credits can seem daunting, but understanding the necessary steps can simplify the process significantly. First and foremost, ensure that your home improvement projects are eligible by verifying that the upgrades meet the specific requirements outlined by the IRS. Generally, installations must include energy-efficient windows, doors, insulation, and HVAC systems. Keep in mind the following key points:

- Check Eligibility: Review IRS guidelines to confirm that the products you plan to install qualify for credits.

- Gather Documentation: Maintain receipts, manufacturer certifications, and energy ratings to support your claims.

- Stay Updated: Tax laws change frequently, so check for updates regarding credit limits and new eligible products.

Once you have established eligibility, the next phase is filing your tax return accurately. Utilize IRS Form 5695 for residential energy credits, which serves as a vital tool for claiming your benefits. Fill out the form with precise details regarding your home improvements and the associated costs. Remember to:

- Calculate Your Credit: The form will guide you in determining the amount you’re entitled to based on your investments.

- Consult a Tax Professional: If you’re unsure about any part of the process, seeking expert advice can help you avoid mistakes.

- File Promptly: Ensure that you submit your tax return before the deadline to secure your rebate.

be proactive in planning future energy efficiency projects, as they can lead to substantial long-term savings and additional tax benefits. Consider making an energy audit a routine part of your home maintenance to identify areas for improvement. Tools such as the following can provide valuable insights:

| Audit Tool | Description |

|---|---|

| Energy Star Home Advisor | Helps identify energy-efficient upgrades with potential tax credits |

| Residential Energy Services Network (RESNET) | Offers certified energy audits to enhance efficiency |

| Home Energy Rating System (HERS) | Measures a home’s energy efficiency and provides improvement recommendations |

Q&A

Q&A: Energy Efficiency Guidelines from the IRS

Q1: What are the energy efficiency guidelines set by the IRS?A1: The IRS provides a framework for energy efficiency through various tax incentives and credits aimed at promoting green practices among businesses and homeowners. These guidelines primarily focus on energy-efficient home improvements and the qualifications necessary for tax credits, such as the Energy Efficient Home Credit (Section 45L) and the Residential Energy Credits (Section 25C). To qualify, upgrades must meet specific criteria, including energy performance standards set by the Department of Energy.Q2: How can I determine if my home improvements qualify for these tax credits?A2: To find out if your home improvements are eligible, you’ll need to ensure that they meet IRS specifications. Typically, this includes installations that improve the energy efficiency of your home, such as energy-efficient windows, heating and cooling systems, and insulation. It’s a good idea to consult the IRS guidelines or a tax professional to confirm that your improvements meet the required standards before applying for credits.

Q3: What types of energy-efficient upgrades does the IRS incentivize?A3: The IRS encourages a variety of upgrades, including but not limited to:

- Energy-efficient windows and doors

- High-efficiency heating and cooling systems

- Insulation and air sealing

- Water heaters and solar energy systems

Q4: Are there any limits on the amount of credit I can claim for energy-efficient improvements?A4: Yes, there are limits associated with the credits offered. For instance, the Section 25C credit allows homeowners to claim up to 10% of the costs of qualifying improvements, with specific dollar limits set for individual products. It’s essential to review these limits to understand how much you can potentially save.

Q5: Do I need to keep receipts and documentation for the improvements I make?A5: Absolutely! Keeping detailed receipts and documentation is crucial, as the IRS may require evidence of your expenditures and the energy efficiency ratings of the products installed if you choose to claim the credit. This may include manufacturer certifications or product specifications indicating that they meet the required energy performance standards.

Q6: How often are these energy efficiency guidelines updated?A6: The IRS periodically updates energy efficiency guidelines to reflect changes in technology, energy-saving standards, and policy incentives. It’s wise to stay informed about any updates, especially before undertaking significant home improvements, to ensure compliance and maximize your potential deductions.

Q7: Is it worthwhile to invest in energy-efficient improvements solely for tax credits?A7: While the tax credits can significantly reduce overall costs, it’s important to assess the long-term benefits of energy efficiency. Improved efficiency often translates to reduced energy bills and a smaller carbon footprint. Ultimately, combining financial incentives with the environmental benefits can make a compelling case for these investments.

Q8: Where can I find more information about the IRS energy efficiency guidelines?A8: The IRS website is the best source for the most current information on energy efficiency guidelines. Additionally, consulting a tax professional experienced in energy credits can provide personalized guidance and help you navigate the specifics of your situation.

0 Comments