In the realm of business ventures, where innovation meets fiscal responsibility, lies a hidden gem waiting to be uncovered: energy efficiency tax credits. These tax incentives offer a powerful opportunity for businesses to not only save on expenses but also contribute to a greener, more sustainable future. Let’s delve into the realm of energy efficiency tax credits for businesses and illuminate the path towards both financial savings and environmental stewardship.

Table of Contents

- Understanding Energy Efficiency Tax Credits for Businesses

- Maximizing Savings through Energy-Efficient Upgrades

- Navigating the Criteria for Eligibility

- Leveraging Tax Credits for Long-Term Sustainability

- Expert Tips for Optimizing Your Energy Efficiency Tax Credits

- Q&A

- Key Takeaways

Understanding Energy Efficiency Tax Credits for Businesses

One way businesses can boost their bottom line and contribute to a greener future is by taking advantage of energy efficiency tax credits. These incentives offer a win-win situation, allowing companies to save on taxes while reducing their environmental impact. Embracing energy-efficient practices not only benefits the planet but also enhances the financial health of businesses.

By investing in energy-efficient technologies and making sustainable choices, businesses can potentially qualify for tax credits that reward these efforts. Whether it’s upgrading to LED lighting, installing solar panels, or improving insulation, each step towards energy efficiency can lead to long-term savings and eco-friendly operations. Taking the initiative to maximize energy efficiency not only demonstrates corporate responsibility but also positions businesses for a more sustainable and cost-effective future.

| Energy-Efficient Upgrades | Potential Tax Credits |

|---|---|

| LED Lighting Installation | $0.60 per square foot |

| Solar Panel Installation | 30% of total costs |

Maximizing Savings through Energy-Efficient Upgrades

One way businesses can leverage energy-efficient upgrades is by taking advantage of tax credits designed to incentivize sustainability practices. These credits not only promote a healthier environment but also provide financial benefits, making it a win-win situation for companies looking to reduce costs and their carbon footprint simultaneously.

By investing in energy-efficient technologies, businesses can qualify for tax credits that not only reduce their tax liability but also contribute to long-term savings through lower energy bills. From upgrading lighting to implementing renewable energy sources, businesses have the opportunity to make environmentally conscious choices while benefiting from substantial cost savings in the process.Start exploring the possibilities of energy-efficient upgrades today to maximize your savings potential and make a positive impact on the planet and your bottom line.

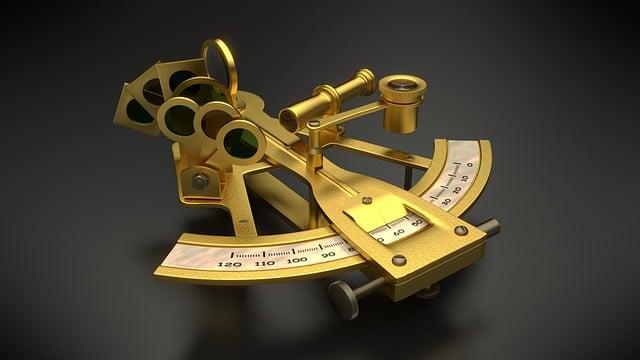

Navigating the Criteria for Eligibility

can sometimes feel like deciphering a complex puzzle. When it comes to energy efficiency tax credits for businesses, understanding the requirements is crucial for maximizing benefits. One key aspect to consider is the type of energy-saving upgrades that qualify for these credits. From installing energy-efficient lighting to upgrading HVAC systems, each improvement can lead to potential savings and tax incentives.

Additionally, keeping track of the documentation needed to support your tax credit claims is essential. This may include energy audit reports, receipts for equipment purchases, and proof of energy efficiency improvements. By maintaining organized records and meeting all eligibility criteria, businesses can not only reduce their energy costs but also contribute to a greener, more sustainable future. Understanding the ins and outs of eligibility requirements ensures that every qualifying business can take full advantage of available energy efficiency tax credits.

Leveraging Tax Credits for Long-Term Sustainability

When it comes to energy efficiency tax credits for businesses, savvy organizations are finding ways to boost their bottom line while reducing their carbon footprint. By leveraging available tax credits, businesses can not only save money but also contribute to long-term sustainability efforts.

One way businesses can take advantage of these tax credits is by investing in energy-efficient equipment and technologies. From LED lighting to solar panels, the options are diverse and beneficial. Additionally, implementing sustainable practices like waste reduction and recycling can further enhance a company’s eligibility for these tax benefits.

Expert Tips for Optimizing Your Energy Efficiency Tax Credits

When it comes to maximizing your benefits from energy efficiency tax credits, incorporating eco-friendly practices in your business operations is key. One effective way to optimize your tax credits is by investing in energy-efficient equipment and technologies. Upgrading to LED lighting, energy-efficient HVAC systems, and implementing smart thermostats are smart choices that not only reduce your energy consumption but also make you eligible for valuable tax credits.

Another expert tip for enhancing your energy efficiency tax credits is to conduct a comprehensive energy audit of your business premises. By identifying areas of energy wastage and implementing energy-saving measures, you not only contribute to a greener environment but also pave the way for additional tax benefits. Remember, every step you take towards energy efficiency not only reduces your carbon footprint but also boosts your bottom line in the form of tax incentives.

Q&A

**Q: What are energy efficiency tax credits for businesses, and how can they benefit companies?**

A: Energy efficiency tax credits for businesses are incentives provided by the government to encourage companies to invest in energy-saving technologies and practices. These credits can benefit businesses in various ways, such as reducing operating costs, increasing competitiveness, and improving sustainability efforts.

Q: How can businesses determine if they qualify for energy efficiency tax credits?

A: To determine eligibility for energy efficiency tax credits, businesses should first review the specific criteria outlined by the government. Typically, businesses must invest in approved energy-efficient equipment or make qualifying improvements to their facilities to qualify for these credits.

Q: What are some examples of energy-efficient upgrades that may be eligible for tax credits?

A: Energy-efficient upgrades that may qualify for tax credits include installing solar panels, upgrading HVAC systems, improving insulation, implementing energy-efficient lighting, and utilizing renewable energy sources. These upgrades not only help businesses save money in the long run but also contribute to environmental conservation efforts.

Q: How can businesses apply for energy efficiency tax credits, and what is the process like?

A: The process of applying for energy efficiency tax credits varies depending on the specific program or incentives available. Businesses typically need to keep detailed records of their energy-efficient investments and expenses to claim these credits accurately. It’s advisable for businesses to consult with tax professionals or experts in the field to navigate the application process smoothly.

Q: What are some key considerations for businesses looking to take advantage of energy efficiency tax credits?

A: Businesses should consider factors such as the potential cost savings, return on investment, long-term benefits, environmental impact, and regulatory compliance when exploring energy efficiency tax credits. By strategically leveraging these incentives, businesses can not only reduce their carbon footprint but also position themselves as leaders in sustainability within their industries.

Key Takeaways

In conclusion, embracing energy efficiency not only benefits the environment but also your business’s bottom line. By taking advantage of available tax credits, you can make strides towards a greener future while saving on operational costs. Remember, every step towards energy efficiency is a step towards a more sustainable and profitable tomorrow. Stay informed, stay efficient, and watch your business flourish in more ways than one. Thank you for exploring the realm of energy efficiency tax credits for businesses with us. Here’s to a brighter, greener, and more prosperous future ahead!

0 Comments