Table of Contents

- Understanding the Basics of the Solar Panel 30 Tax Credit

- Maximizing Your Savings: How to Qualify for the Tax Credit

- Step-by-Step Guide to Claiming the Solar Tax Credit

- Common Misconceptions About Solar Tax Credits

- Future of Solar Incentives: What Lies Ahead for Homeowners

- Q&A

- Wrapping Up

Understanding the Basics of the Solar Panel 30 Tax Credit

The Solar Panel 30 Tax Credit, officially known as the Investment Tax Credit (ITC), allows homeowners and businesses to receive a considerable tax deduction for installing solar energy systems. This incentive not only promotes the adoption of renewable energy but also significantly offsets the upfront costs of solar panel installation. The percentage of the credit has varied in recent years, but as of 2023, it is set at 30% of the total installation cost, making it a substantial benefit for qualifying installations.

To take advantage of this credit, it is important for homeowners and businesses to ensure that their solar panel systems meet specific criteria. Key eligibility requirements include:

- Placed in service: The solar panel system must be installed and operational within the applicable tax year.

- System Ownership: Taxpayers must own the solar system; leasing or power purchase agreements may not qualify.

- Qualified expenses: The credit applies only to the cost of solar panels, installation, equipment, and other associated costs.

Claiming the Solar Panel 30 Tax Credit involves completing the necessary IRS forms, typically attached to annual tax returns. For clarity, here’s a simple table summarizing the requirements and incentives associated with the tax credit:

| Criteria | Details |

|---|---|

| Credit Percentage | 30% |

| Eligibility | Homeowners & Businesses |

| Claiming Process | IRS Form 5695 |

| Expiration Date | Originally set to decrease, but extended until 2032 |

Maximizing Your Savings: How to Qualify for the Tax Credit

Qualifying for the federal tax credit for solar panels can significantly reduce your overall financial investment in renewable energy. To take advantage of this benefit, homeowners must meet specific requirements set by the IRS. First and foremost, you need to ensure that your solar energy system is installed on your primary residence or a second home. Here’s what else you should consider:

- Ownership: You must own the solar panel system outright. Leasing or financing through a solar power purchase agreement (PPA) typically does not qualify for the tax credit.

- Installation Expenses: Keep meticulous records of the total installation costs, including solar panels, inverters, wiring, mounting equipment, and any labor involved.

- System Capacity: Your solar system should meet the necessary capacity requirements that align with IRS guidelines to maximize the tax credit.

Understanding the deadline for filing your tax credit claim is just as vital. The credit is available for systems placed in service by December 31st of the year you are claiming it. To illustrate the potential savings, consider the following table:

| Installation Year | Percentage of Tax Credit | Example of $20,000 System |

|---|---|---|

| 2023 | 30% | $6,000 |

| 2024 | 26% | $5,200 |

| 2025 | 22% | $4,400 |

By ensuring that you meet qualification requirements and taking advantage of the available deadlines, you can maximize your savings through the solar tax credit. Additionally, consulting with a tax professional may provide further insights tailored to your financial situation, ensuring that you capitalize on every opportunity available to reduce your tax liability.

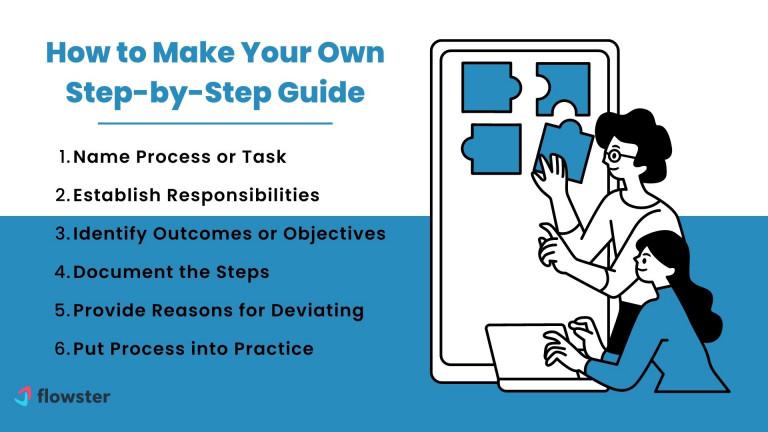

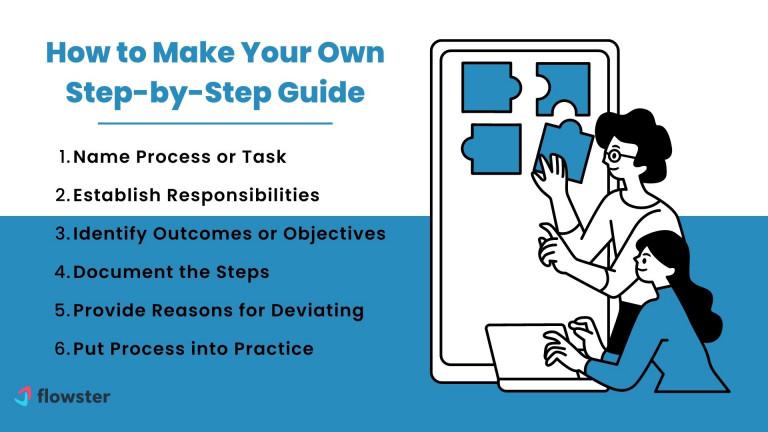

Step-by-Step Guide to Claiming the Solar Tax Credit

Claiming the solar tax credit involves a straightforward process, but it’s crucial to stay organized to maximize your benefits. Start by ensuring you have installed eligible solar panels on your property. This includes both residential and commercial installations, as long as they meet the IRS requirements. Gather all necessary documentation, such as your solar panel purchase agreement, installation invoices, and any other relevant receipts. Documenting your project’s timeline is essential, especially if you’ve utilized a loan or financing options to cover costs.

Once you have your documentation in order, it’s time to fill out the appropriate IRS form, which is Form 5695 — Residential Energy Credits. This form not only helps calculate your credit but also guides you through the eligibility requirements. You’ll need to include your total solar energy system cost, including labor for onsite preparation, assembly, or original installation. Keep in mind that the amount you can claim may vary based on factors such as the size of the installation and the date of purchase.

After completing your tax form, incorporate it into your annual tax return process. If you’re filing your taxes electronically, most tax software will include the necessary prompts to guide you through incorporating the solar tax credit. For those opting for manual filing, ensure you attach Form 5695 to your Form 1040. Double-check your local regulations, as some states may have additional requirements or forms. Following these steps ensures you can take full advantage of the solar tax credit and support your sustainable energy goals.

Common Misconceptions About Solar Tax Credits

Many homeowners interested in solar energy have heard about tax credits, but myths often cloud understanding. One frequent misconception is that these incentives are only available for new installations. In reality, if you installed solar panels in the previous year, you might still be eligible for the federal tax credit. This means you can take advantage of savings even if your system is not brand new. Ensure you keep all relevant documents handy, as they will be necessary when filing your taxes.

Another common myth is that solar tax credits can only be claimed by homeowners. This is not entirely true, as businesses can also benefit from these credits. Both residential and commercial systems are eligible for the same percentage of the tax credit, allowing businesses to reduce their operational costs significantly. When considering this, it’s essential for business owners to assess how solar panels could impact their overall financial strategy and environmental footprint.

many believe that the tax credit covers the entire cost of the solar installation. While the 30% tax credit significantly reduces expenses, it doesn’t cover all costs. Homeowners still need to arrange financing for the upfront costs and may want to explore options for loans or leases. It’s important to calculate the actual investment against potential savings over the panel’s lifespan to fully understand the financial implications.

Future of Solar Incentives: What Lies Ahead for Homeowners

The future of solar incentives for homeowners is looking increasingly promising as governments and industries recognize the importance of sustainable energy solutions. With the recent emphasis on renewable energy, homeowners can expect to see enhanced programs and incentives that make solar energy even more accessible. Tax credits will likely play a pivotal role, encouraging homeowners to invest in solar technology, which not only benefits the environment but can also lead to significant savings on energy bills.

In the coming years, we may see improvements in various solar incentive programs, such as:

- Extended Tax Credits: Continued or newly established tax credits could offset installation costs.

- State-Level Incentives: Individual states might introduce or expand additional rebate programs aimed at encouraging solar adoption.

- Grant Programs: There may be more funding available through governmental agencies to support solar projects, especially for low-income households.

Furthermore, advancements in technology and decreasing costs of solar panels will likely contribute to a surge in efficiency and affordability. Homeowners will be able to take advantage of innovative financing options, making solar energy not only appealing but also financially viable. As laid out in the table below, this combination of economic incentives, technological advancements, and public support will create a vibrant landscape for solar energy adoption among homeowners:

| Incentive Type | Potential Savings | Implementation Timeline |

|---|---|---|

| Federal Tax Credit | Up to 30% of installation costs | Until 2032 |

| State Rebates | Varies by state | Annual appropriations |

| Low-Interest Loans | Reduced financing costs | Varies by program |

0 Comments